- Eliminate your Debt

- Set Saving Goals

- Invest your Savings

- Automate Your Savings

- Review and Cut Your Expenses

- Make a Budget and include saving in it

- Unsubscribe from Marketing Emails

- Cut down on your grocery budget: Here’s How.

- Refinance your Mortgage

- Check your Insurance Rates

- DIY . . . Everything!

- Use Cash-back Apps and Coupons

- Put a Spending Limit on your Card

- Start a Side Hustle

- Make saving a habit

- Bonus

- Conclusion

You can click on the image below to view the infographic or keep reading the text version 😀

When it comes to save money, we all get very ambitious.

Here’s a Fact on average, there was $62,000 in every personal savings account in 2022. And this amount did not count Investments in it.

How they were able to do that?

How can you save money without sacrificing your Happiness?

Any Working Ways?

Here are the most effective ways to save money, which I have compiled for you!

In this Ultimate Guide, I am going to show you exactly how you can use some simple ways to save your hard-earned money, step-by-step.

The Big Problem with Saving: Debt.

In the United States only, there is a $93,785 debt on each citizen.

Eliminating debt can be a challenging and time-consuming process, but it is possible to do so with the right strategies and plan.

Here is step-by-step, how to do that:

First, Make a budget if you haven’t yet. And if you have made one then be sure to make changes to it considering your debt payments.

Budgeting is mentioned in almost every personal Finance article as it is an extremely important phase to achieve anything in Finance.

In this budget, you need to understand how much you owe and to whom.

Make a list of all your debts, including the creditor, the interest rate, and the minimum monthly payment.

This will help you see the full picture of your debt and prioritize which debts to pay off first.

Second, Once you know how much you owe, use the debt avalanche strategy to pay it off.

This involves consolidating your debts into a single loan with a lower interest rate and focusing on paying off the debts with the highest interest rates first.

You should keep an eye on your credit cards, as they are the biggest contributors to your debt if you take them easy.

You should always try to maintain your credit card Score as it will give you many advantages in numerous places.

High Credit Scores can get you access to more options, lower interest rates, and more lender choices.

But paying off debt without sacrificing is only possible when your income increases. So your main focus should be your income.

If you’re having trouble coming up with a repayment plan on your own, consider seeking the help of a financial professional or a non-profit credit counseling agency.

They can provide guidance and resources to help you get your debt under control.

OK, Fine ~

You need to pay off your debt asap to save money, but how would you know how much to save?

In other words, what should be the end Goal?

Well, here comes our next Chapter:

How does “Saving Goals” makes it easier to save for beginners?

Setting saving goals can be a helpful way to stay motivated and focused on reaching your financial goals.

Setting Goals can result in higher yields in any industry.

Here is a step-by-step guide on how to actually set Goals for savings:

First, Determine your goal: Figure out what you want to save for.

This could be a short-term goal like saving for a down payment on a car, or a long-term goal like saving for retirement.

Secondly, you’ll need to set an amount by determining how much you need to save to reach your goal.

Consider the costs associated with your goal, as well as how much time you have to save.

For example, If you want to save money to buy a laptop and you know that the new year is coming and it will be on sale by then, so in this case, you had to determine the time to Save Money

In the Third part, you must create a plan and stick to it!

This might include setting a budget, finding ways to increase your income, or saving a specific amount from your next month’s groceries shopping.

You can add anything to it on which you find that you a same some money.

The Forth and most important part includes tracking your progress and forcing yourself for your own well-being.

It includes preventing yourself to spend on extra comforts and entertainment which are just an overdose of dopamine.

Now here’s a Bonus Tip, Start by Setting short-term goals.

They can be especially helpful because they can provide a sense of accomplishment and motivation to continue working towards longer-term goals.

For example, if your long-term goal is to save for retirement, you might set short-term goals to save a certain amount each month or to pay off a certain amount of debt.

Achieving these smaller goals can give you a sense of accomplishment and encourage you to continue working towards your larger goal.

And that’s what matters!

Here is a quick example that you can implement too:

If Your goal is to pay off your debt completely and you owe thousands of dollars then I’ll recommend you make a Short-term Goal to pay at least $1000 dollars every month in debt repayments.

Once, your debt starts to come down and you have some income leftover in your hands.

The next step comes when you think about where you should keep your hard-earned savings.

Which is investing your savings in an Index Fund.

Invest your Savings

“The biggest risk of all is not taking one.”

Said by Mellody Hobson

Assuming you are 30 to 40 years old now, At this point of age, you should be investing every penny you save.

I am talking about investing in Index Funds only!

Because at this point, you should be investing in only the save market.

Keeping in mind the Inflation rates of the US, we can assume that it will grow around 3.8% next year. If everything went fine -you know what I mean, Covid😗

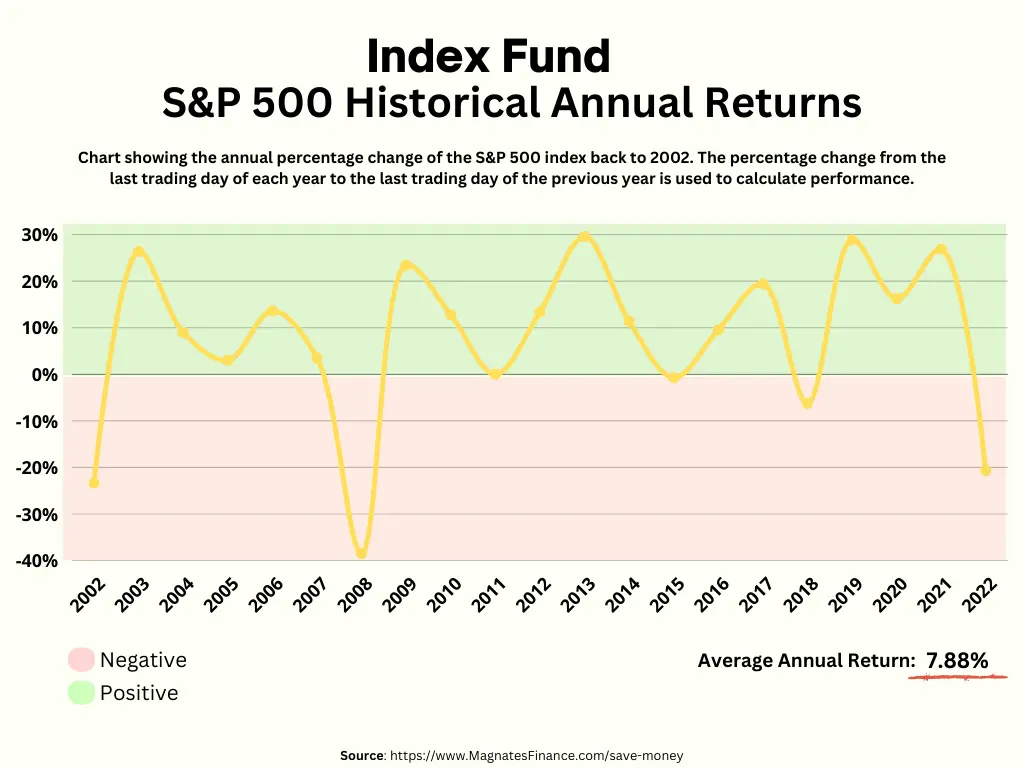

If we invest our savings in an Index Fund like S&P 500 and look at its returns over the last 20 years, it gives an average return of 8.91%.

We can see it will easily overcome the 3.8% of inflation…

Now how can you invest in Index Funds?

As usual, here is a step-by-step guide on how to do that!

I will only tell you the summary of it in steps if you want an in-depth guide on it, you can find one on Forbes Advisor

First, Open an Investment Account.

You’ll need an investment account to buy index funds. Different types of investment accounts are best suited for various goals:

If you have Financial Goals, then a Taxable brokerage account will be a great fit for you.

If you want to save for retirement, an IRA or a 401(k) provides tax benefits to help you save for retirement.

These accounts are ideal for long-term investment Because Withdrawals before retirement could cause penalties and heavy taxes.

For now, we will continue with the first one, the Taxable brokerage account.

Second, If you have little to no experience in the world of investing then I highly recommend you consult a professional adviser.

Which will create an investment strategy for you.

Once you have your strategy in your hands. The third step comes…

Third, Deeply Research Your Index Funds before investing in them.

Like I have referred to S&P 500 a lot before in this guide, but you should always do your research yourself or again consult a professional for it.

Again, you can go in-deep into it in the Forbes Article mentioned above.

The Fourth step is to buy the Index Fund you are willing to invest in.

You can purchase shares of the index funds you’ve chosen once you’ve opened a brokerage account.

Fifth, set up a purchasing plan for your funds.

In this step, you have to decide about your plan for buying index funds over time.

It is recommended by the advisors to use dollar-cost averaging.

It is the practice of investing a certain amount of money into your investments at set intervals.

In general, investing is a long game: While the stock market has its ups and downs, buying and holding a diverse investment mixture throughout your investing career has historically resulted in successful returns.

Now, the Sixth and most important step is to make an Exit strategy.

Although buying and holding is a smart investment strategy, but you should also consider when and how you will sell your stock.

A financial advisor or tax advisor can assist you in determining the best strategies for managing withdrawals from any type of investment account.

But for investing your savings you must save money first.

Now, what is the best Simple way to resume your savings?

and that’s when “Automating your Savings” comes in…

Automating Your Savings: A simple way to achieve your saving goals

Did you know you can save money without even realizing it?

Yup! Nowadays, almost every bank allows you to set up automatic transfers between your checking and savings accounts.

Users can specify when, how much, and where they want their money transferred.

You can even split your direct deposit so that a portion of each paycheck goes directly into your savings account.

You can also use apps like Digit or Qapital to help you with some of the work.

They will transfer small amounts from your checking account to a separate savings account for you after you sign up.

You won’t have to waste time or energy considering a transfer this way.

You can learn more about them in this Forbes Advisory Article.

After automating your savings, your next step is to review your own expenses and cut them down.

Scared? Don’t worry here is how to save money without sacrificing your happiness.

Review and Cut Your Expenses

If you are unable to save as much as you would like, it may be time to reduce your spending.

Determine which non-essentials, such as entertainment and dining out, you can cut back on.

Look for ways to cut your fixed monthly expenses, such as car insurance and cell phone plans.

Here are a few tips for reducing daily expenses that work really well:

- Look for free or low-cost alternatives: Instead of spending money on entertainment, consider finding free or low-cost options such as going for a hike or having a picnic.

- Reduce unnecessary expenses: Take a look at your expenses and see if there are any that you can eliminate. For example, do you really need that expensive gym membership or could you get your exercise by going for a run or doing a workout at home?

- Shop around for the best prices: Before making a purchase, take the time to shop around and compare prices. You may be able to find the same item for a lower price at a different store or online.

- Consider negotiating your bills: If you are paying for services such as cable or internet, consider negotiating your bill to get a lower rate. Companies are often willing to lower prices to keep customers from switching to a competitor.

- Cut down on dining out: Eating out can be a major expense, so try cooking at home more often. Not only will this save you money, but it can also be healthier.

- Avoid impulse purchases: It can be easy to make impulse purchases when you see something you want, but these can add up quickly. Try to think carefully before making a purchase and ask yourself if it is something you really need.

Here are two rules you can use to reduce your non-essential purchases:

- 24-Hour Rule: With a self-imposed 24-hour rule, you can avoid buying expensive or unnecessary items on impulse. Wait 24 hours before purchasing any non-essential item. It’s ideal for online shopping, where items can be added to your cart and purchased later.

- 30-day rule: If you find the 24-hour rule not working for you. You can use the 30-day rule. Because in this much time you will most likely know the importance of the thing you were going to buy and also do you really need it or not. And If lucky, the retailer may even send you a coupon code if you abandon your cart.

You should always determine your Financial Priorities because it is an important step in managing your personal finances and achieving your savings goals.

It involves assessing your current financial situation and identifying the most important financial objectives that you want to achieve, such as saving for retirement, paying off debt, or building an emergency fund.

It’s also important to periodically review and adjust your financial priorities as your needs and circumstances change.

By understanding your financial priorities, you can create a budget and financial plan that focuses on the most important areas of your finances and helps you make progress toward your goals.

So let’s talk about creating a budget and how to optimize it for your savings…

Make a Budget and include saving in it

Making a budget is a great way to take control of your finances and ensure that you are saving enough money.

Here are some steps you can follow to create a budget that includes saving:

- Determine your income: The first step in creating a budget is to determine how much money you have coming in each month. This includes your salary, any other income sources, and any additional income you may receive regularly.

- Identify your expenses: Next, you’ll want to make a list of all of your expenses. This includes fixed expenses like rent or mortgage payments, as well as variable expenses like groceries and entertainment. Be sure to include everything you spend money on, no matter how small.

- Compare income and expenses: Once you have a list of your income and expenses, compare them to see if you are spending more than you are earning. If you are, you’ll need to make some adjustments to your budget to bring your expenses in line with your income.

- Make a plan: Now that you have your saving goals in place, it’s time to make a plan for how you’ll reach them. This may involve cutting expenses, increasing your income, or a combination of both. Be sure to track your progress and make adjustments as needed to stay on track.

- Revisit your budget regularly: It’s important to review your budget regularly to ensure that you are still on track to meet your saving goals. This will also allow you to make any necessary adjustments as your circumstances change.

Learning to budget and understand your finances is an important skill that can have numerous benefits.

By creating a budget, you can keep track of your spending and see exactly where your money is going each month.

This can help you to make adjustments as needed to ensure that you’re not overspending.

In addition to helping you keep track of your spending, a budget can also help you to achieve your financial goals.

Whether you’re saving for a down payment on a house, planning for retirement, or trying to pay off debt, a budget can help you stay on track and make progress toward your goals.

Understanding your finances and creating a budget can also help you to avoid financial stress.

When you have a good understanding of your financial situation, you’re less likely to feel overwhelmed or stressed about money.

This can lead to a more positive outlook and a greater sense of control over your life.

Finally, having a good understanding of your finances can also help you to make informed decisions about your money.

For example, you’ll be better equipped to decide whether to invest in a particular stock or to take out a loan.

Overall, budgeting and understanding your finances is an essential skills that can help you take control of your money and achieve your financial goals.

Now let’s talk about another way that saves you a lot of money and most of us don’t even notice it.

Which is to Save your windfalls and tax refunds.

Unsubscribe from Marketing Emails: That force you to spend money!

Did you know that unsubscribing from marketing emails can actually save you some cash?

It’s true!

When you have fewer emails cluttering up your inbox, you’re less likely to make impulsive purchases based on promotional offers.

Plus, if you’re paying for an email service, like Gmail, having fewer emails can help you save on storage costs.

And let’s be real, who doesn’t want to save time by having to sort through and delete fewer emails?

As you know Email marketers are extremely skilled at what they do.

They understand the irresistible attraction of a 24-hour sale or an exclusive coupon.

If you find yourself unable to resist a special offer, simply click the unsubscribe link at the bottom of the email.

You have to Do it! You’ll be less tempted to spend money, and your inbox will be much cleaner.

Unsubscribing from marketing emails is a win-win!

The next step could be beneficial for those who shop like they are millionaires 😁…

Cut down on your grocery budget: Here’s How.

I have published a detailed article on how to Save Money on Groceries below on this website. You can read it here: 15 Top Tips To Save Money on Groceries

Here is a summary of it,

Here are the few tips from that article to save money on groceries:

- Make a budget and stick to it: Determine how much money you can afford to spend on groceries each month and try to stay within that budget.

- Use coupons and discount codes: Look for coupons in the newspaper or online and use discount codes when shopping online.

- Plan your meals: Make a weekly meal plan and a corresponding grocery list to help you avoid impulse purchases.

- Buy in bulk: Buying in bulk can save you money, as long as you are able to use the items before they expire.

- Buy store brands: Store-brand items are often just as good as name-brand items and can be significantly cheaper.

- Don’t shop when you’re hungry: It’s easier to stick to your budget and resist temptations when you’re not hungry.

- Shop the sales: Keep an eye out for sales and stock up on items when they are discounted.

- Use cash instead of credit: Using cash can help you stick to your budget and avoid overspending.

- Don’t be afraid to negotiate: If you find a mistake in the price of an item, don’t be afraid to ask for a discount.

- Use apps and websites: Some many apps and websites can help you find the best deals and discounts on groceries.

You can find more useful tips in the article mentioned above…

Now, without wasting any time let’s jump straight to the next step.

Refinance your Mortgage

Refinancing your mortgage can potentially save you money by getting you a lower interest rate, lower monthly payments, or a shorter loan term.

It’s worth looking into if you think it could help your financial situation.

Just make sure to compare the terms of your current mortgage to a refinance loan before making a decision.

With interest rates so low these days, run the numbers to see if refinancing could help you save money and cut years off your mortgage.

If you can get a lower interest rate, refinancing your mortgage can save you hundreds of dollars per month.

While refinancing has some upfront costs, they can be recouped over time as you start paying less each month.

After refinancing your mortgage your next should be checking your insurance rates.

Check your Insurance Rates

Checking your insurance rates can help you save money by allowing you to compare rates from different insurance companies and choose the one that offers the best coverage at the lowest price.

By shopping around and comparing rates, you may be able to find an insurance policy that fits your needs and budget.

Additionally, checking your insurance rates on a regular basis can help you stay up to date on any changes in the market that might affect the cost of your insurance.

This can help you make sure that you are always getting the best deal possible on your insurance.

After this, here is another step for a person who is creative and a “DIY” type of person.

DIY . . . Everything!

Before you spend money on a new backsplash, fancy light fixture, or bench, consider doing it yourself!

Generally, the cost of materials and a quick Google or YouTube search will save you a bunch on your latest home improvement project.

Furthermore, you will not have to pay someone to do something that you can most likely do yourself.

However, if you’re the type who can’t seem to hit the nail on the head, you might want to enlist the assistance of a friend or neighbor to save money on new drywall.

Once you have started Doing everything yourself, here is another tip for you…

Use Cash-back Apps and Coupons

When it comes to saving money, nothing beats a good, old-fashioned 20% off coupon.

But did you know there are numerous cash-back apps available to help you stretch your savings even further?

Look into Ibotta, Rakuten, and Honey (a browser extension).

Although the concept of couponing may appear outdated, finding bargains does not always necessitate clipping sections of the Sunday newspaper.

When shopping online, take a few minutes to look for a coupon code in the “promo code” box on the checkout page.

It would help you a lot while saving money!

It’s awesome because it helps you lower the overall cost of things and makes your budget go further.

Plus, using these apps and coupons can also help you make smarter shopping decisions because you can compare prices and deals from different places.

That way, you can be sure you’re getting the best deal and getting the most value for your money.

Now, it’s time for a Pro tip!

Which is to Put a spending limit on your card.

Put a Spending Limit on your Card

I know it sounds scary, but if you are really concerned about your savings then this could be the harshest but most effective way in which you save a bunch of money.

Setting a spending limit on your credit or debit card can be a great way to save money and improve your financial situation.

It helps you budget and avoid overspending, reduces impulse purchases, and can even improve your credit score.

Plus, if you pay off your balance in full each month, you won’t have to worry about paying interest charges on your credit card.

All of these things can add up to some serious savings over time.

So, it’s definitely worth considering setting a spending limit on your credit card if you want to better manage your money and reach your financial goals.

After restricting your spending, if you further want to boost your savings here is a way, Start a side hustle!

Start a Side Hustle

If you want to significantly increase your monthly savings, consider starting a side hustle

If you can afford it, it can be especially motivating to direct all of the money generated by your side hustles directly into your savings account.

However, keep an eye out for exhaustion.

Your mental health is more important than any savings goal you may have!

Starting a side hustle can be a great way to save extra money.

Some people do it to earn a little extra spending money, while others use it as a way to save for long-term financial goals, like saving for retirement or paying off debt.

There are many side hustles you can start now, depending on your skills and interests.

Some ideas include:

- Freelance work: If you have a particular skill, like writing, design, or programming, you can offer your services on a freelance basis.

- Selling products: You can start a business selling products, either online or at local markets.

- Renting out a room: If you have an extra room in your home, you can rent it out on Airbnb.

- Dog walking or pet sitting: If you love animals, you can start a business providing dog walking or pet sitting services.

- Tutoring: If you excel in a particular subject, you can offer tutoring services to students.

- Lawn care: If you enjoy outdoor work, you can start a lawn care business.

- Social media consulting: If you are skilled in social media marketing, you can offer your services to small businesses.

- Event planning: If you are organized and enjoy planning events, you can start a business planning parties and other events.

- Home repair or handyman services: If you have experience in home repair or are handy with tools, you can offer your services to homeowners.

- Virtual assistant: If you are good at multitasking and have strong organizational skills, you can work as a virtual assistant for busy professionals.

There are many other side hustle ideas, so you should be able to find something that fits your skills and interests.

Good luck!

And lastly, Make saving a habit.

Yes, make it a habit.

Make saving a habit

Finally, Saving money on a regular basis can bring a number of benefits to your financial life.

Saving money is an important financial habit to cultivate.

Not only does it give you a financial cushion to fall back on in case of unexpected expenses, but it can also help you achieve your long-term financial goals, such as buying a house or retiring early.

Saving can also help reduce financial stress and provide a buffer in case of economic downturns, such as job loss.

In short, building a savings habit can be a key factor in building a more secure financial future and achieving financial stability.

Bonus:

As a bonus, here is an ideal proportion of your budget:

Here is how to divide your income between your needs:

- Rent 25%

- Utilities 15%

- Education of your Children 15%

- Entertainment 5%

- Grocery 30%

- Saving / Debt Payment 10%

And if you are lucky and don’t have any rent or mortgage to pay then you can use this 25% to pay off your Debt or just save that money.

If you are able to follow this pattern, then congrats!

And if you are not, then their still time to do that. Good Luck!

Conclusion

That’s quite a Guide.

To summarize, here are the most important steps to save money in 2023:

- Eliminate your Debt

- Set Saving Goals

- Automate Your Savings

- Review and Cut your Experience

- Put a Spending Limit on your Card

- Start a Side Hustle

- Include Savings in your budget

- Refinance your Mortgage

- Use Cash-back Apps and Coupons

Now I’d like to hear from you:

Which Step from this list was new to you?

Or maybe I missed something.

Either way, let me know by leaving a comment below.

The point of view of your article has taught me a lot, thank you.